7 Essential Iqama Renewal Fees Every Expatriate Must Know

Iqama renewal fees are now a major concern if you’re one of the millions of expatriates living in Saudi Arabia. The Ministry of Interior just rolled out new service charges of SAR 51.75 through Absher Business. These changes took effect on January 1, 2025.

Understanding iqama renewal fees is essential for planning your legal stay in the Kingdom. You can’t afford to be caught off guard by these costs when renewal time comes around. These costs impact both your personal budget and what your employer has to pay.

You need to include them in your financial planning immediately. Don’t wait to start budgeting for these expenses.

Both you and your company need to prepare for these obligations well in advance. Every expatriate working in Saudi Arabia must navigate the complex landscape of residence permit costs to maintain their legal status. Don’t let your renewal deadline slip by!

Missing it could cost you SAR 500 or more in fines. That’s why you need to plan your finances ahead of time.

This guide walks you through everything you need to know about current fees, payment options, and recent rule changes. You’ll have all the details to make your renewal process smooth and stress-free.

Table of Contents

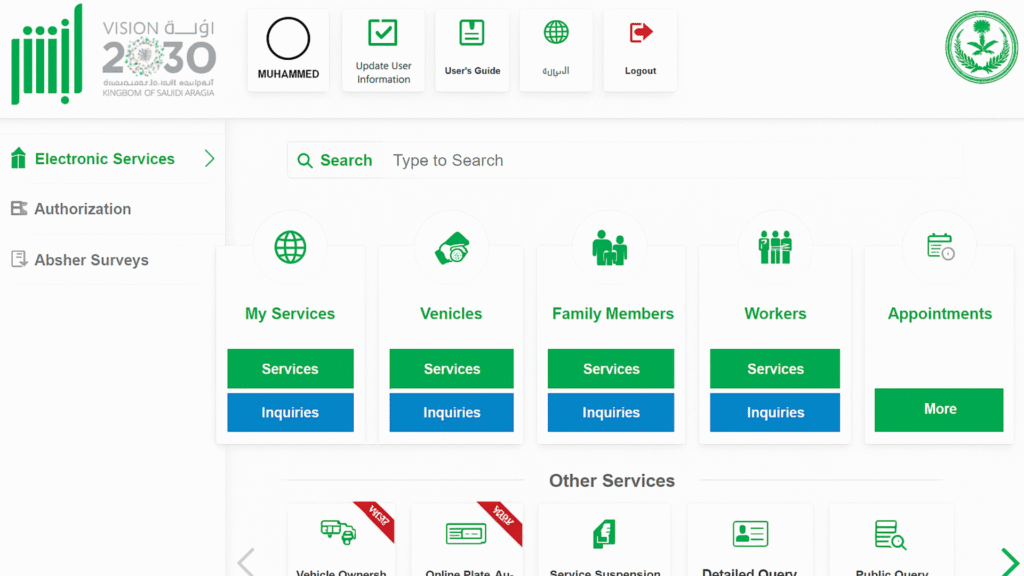

Absher Business iqama renewal fees

Every year, thousands of businesses across Saudi Arabia face the same headache – figuring out how much they’ll need to budget for employee iqama renewals. The fees seem to change regularly, and with most processes now moving through Absher Business, it’s gotten easier to complete renewals but harder to keep track of the actual costs involved.

What are Absher Business iqama renewal fees?

Absher business iqama renewal fees represent the latest digital transformation in how expatriates and employers manage residence permit renewals in Saudi Arabia. The Ministry of Interior introduced new service charges through the Absher Business platform effective January 1, 2025.

Absher business Iqama Extension Fees now include a SAR 51.75 processing fee for each renewal transaction. This fee applies specifically to value-added services provided through the platform and remains separate from the standard SAR 650 annual residence permit cost.

Expatriates working for companies using Absher Business will notice these additional charges on their renewal invoices. The system makes life easier for your employer too. They can now renew multiple foreign worker documents at once instead of doing them one by one.

This means faster processing times for you. You’ll get digital confirmation of your renewal status right away.

Your company can track all renewals through one simple dashboard. This helps them stay compliant and keeps everything organized. It’s a win-win situation that saves everyone time and hassle.

How to Pay iqama renewal fees on Absher

Absher business iqama renewal fees payment process has been simplified for both employers and expatriates through multiple digital channels. Employers can now pay these fees directly through the Absher Business portal using registered company bank accounts.

Absher business iqama renewal fees can also be settled through SADAD payment system, which connects to major Saudi banks including Al Rajhi, NCB, and Riyad Bank. Expats whose employers delegate payment responsibilities can use mobile banking applications to complete transactions.

The payment interface automatically calculates total costs including the base renewal fee, work permit charges, and any applicable dependent fees. Foreign workers receive SMS confirmations once payments are successfully processed.

Real-time payment tracking allows expatriates to monitor their renewal status through the Absher Individuals app. The system immediately updates residence permit validity periods upon successful payment completion.

Troubleshooting Absher Issues

You might run into some common tech issues when using the platform. These include login problems, payment timeouts, and trouble uploading your documents.

The system gets really busy during peak renewal times. This usually happens in the last three months of each year.

Expect slower loading times and occasional glitches during these busy periods. Plan ahead and try to renew early if possible. This way, you can avoid the rush and potential technical headaches.

You might also face biometric data issues during your renewal process. Sometimes your fingerprints or facial scans won’t match what’s already in the system. This mismatch can cause delays and frustration.

This requires visits to Jawazat centers for data updates before online renewal can proceed.

Payment rejection issues often occur when bank accounts have insufficient funds or when credit cards have expired. Expatriates should verify their payment methods before initiating renewal processes to avoid delays.

Your browser might be causing problems if you can’t access certain features on the platform. This happens more often if you’re using an older phone or computer. The system works best with updated browsers like Chrome, Safari, or Firefox.

Make sure your browser is up to date before you start your renewal process. This simple step can save you lots of trouble later.

Iqama renewal fees for 1 Yea

Most companies opt for the standard one-year iqama renewal since it strikes the right balance between cost and administrative convenience. Before diving into your budget planning, here’s exactly what you can expect to pay when processing these renewals through the Absher Business system.

Fee Structure for 1-Year Renewals

Iqama renewal fees for 1 year consist of multiple components that residents in Saudi Arabia must budget for annually. The base residence permit fee remains fixed at SAR 650 for all expatriates regardless of nationality or profession.

Iqama renewal charges for 1 year also include the mandatory work permit fee of SAR 9,600, which employers typically pay on behalf of their international employees. This represents SAR 800 monthly, payable for a minimum three-month period.

Health insurance costs add another SAR 600-1,000 annually depending on coverage levels selected by overseas employees or their employers. The Council of Cooperative Health Insurance mandates valid coverage for all renewal applications.

Additional administrative fees through Absher Business now total SAR 51.75 per renewal transaction. Expats working for companies using this platform will see these charges reflected in their total renewal costs.

Comparison with Multi-Year Renewals

Iqama extension fees for 1 year remain the standard option for most international employees, though Saudi Arabia has introduced quarterly renewal flexibility for specific circumstances. The quarterly option costs SAR 163 for three months, SAR 325 for six months, and SAR 488 for nine months.

Iqama renewal fees for 1 year provide better value compared to shorter renewal periods when calculated on a monthly basis. If you’re paying quarterly, you’ll end up spending more on administrative fees. Those repeated processing charges really add up over time.

Annual renewals are your best bet for stability and less paperwork hassle. You won’t have to deal with renewal stress as often throughout the year. Your employer prefers the annual cycle too.

It keeps their HR team’s workload manageable and ensures they stay legally compliant without constant renewals.

The Green Iqama program introduced for skilled expatriates offers multi-year validity but maintains the same annual fee structure. This program targets professionals in Vision 2030 priority sectors including technology, healthcare, and engineering.

Payment Deadlines and Penalties

Iqama renewal fees for 1 year must be paid at least three days before the current permit expires to avoid penalties. The Saudi government enforces strict deadlines to maintain accurate expatriate population records.

First-time violations result in SAR 500 fines added to the standard iqama renewal fees for 1 year. Second violations double the penalty to SAR 1,000. This creates a huge financial burden if you don’t stay compliant with your renewal deadlines.

Third-time violations can lead to deportation proceedings. This makes timely renewal absolutely critical for your continued legal residence. Immigration authorities keep digital records of all your violation history.

These records follow you throughout your time in the Kingdom, so don’t take any chances with late payments.

Expats can check their current expiry dates through the MOI website, Absher app, or by examining their physical residence cards. Setting calendar reminders 30 days before expiry helps avoid last-minute payment rushes.

Iqama renewal fees in Saudi Arabia

Getting your iqama renewed shouldn’t be a guessing game when it comes to costs, but many residents find themselves scrambling to understand the current fee structure. Whether you’re handling your own renewal or managing multiple employees’ iqamas, knowing the exact charges upfront can save you from unpleasant surprises at the payment stage.

What are iqama renewal charges in Saudi Arabia?

Iqama renewal fees in saudi arabia cover all the costs you need to pay to keep your legal residence status in the Kingdom. These fees apply to millions of foreign workers just like you who call Saudi Arabia home. The Ministry of Interior sets these fees every year.

It’s part of their broader plan to manage immigration policy across the country.

Understanding these costs helps you budget better and stay compliant with Saudi law. Iqama extension fees in saudi arabia include the fundamental SAR 650 residence permit charge, which remains consistent across all international employees categories. This fee covers administrative processing, biometric data updates, and digital system maintenance.

Recent regulatory changes have added platform-specific charges to iqama renewal fees in saudi arabia. The Absher Business system now includes SAR 51.75 transaction fees for corporate-sponsored renewals.

These fees support Vision 2030 initiatives aimed at improving digital government services for expatriates. The revenue helps fund technological upgrades and streamlined processing systems that benefit all residents.

Sector-Based Differences for Expatriates

Iqama renewal fees in Saudi Arabia vary significantly between the public and private sectors. Government employees often receive subsidized renewal costs as part of their employment packages.

Private sector expatriates face the full iqama renewal payment in Saudi Arabia burden, including work permit charges of SAR 9,600 annually. Small businesses with fewer than nine employees may qualify for exemptions covering up to four foreign workers.

Healthcare professionals working in Ministry of Health facilities receive priority processing and reduced fees. Engineering expatriates in mega-projects like NEOM may benefit from special renewal packages negotiated by their employers.

Domestic workers represent a special category where iqama renewal fees in saudi arabia follow different structures. Saudi sponsors pay reduced work permit fees starting from the third domestic employee for expatriate sponsors or fifth for Saudi sponsors.

How to Check iqama renewal fees Online

You can double-check your iqama renewal fees in saudi arabia through several official channels before you pay. Don’t just guess at the amount – verify it first to avoid any surprises.

The Ministry of Interior website has real-time fee calculators that work based on your specific situation. Just enter your details and you’ll get the exact amount you need to pay. It’s that simple and accurate.

Expatriates can check current iqama renewal fees in saudi arabia through the Absher portal by logging in with their residence number and password. The system displays all applicable charges including dependent fees and work permit costs.

The Ministry of Labor website offers work permit fee verification tools for international residents wanting to confirm their employer’s payment status. This transparency helps prevent payment disputes between employers and employees.

Third-party banking applications including Al Rajhi, NCB, and Arab National Bank provide fee checking services through their government payment sections. These tools help you budget for upcoming renewals.

Family iqama renewal fees in Saudi Arabia

Managing iqama renewals becomes significantly more complex when you’re dealing with an entire family rather than just individual applications. Each dependent adds another layer of paperwork and fees, making it crucial for families to understand the total financial commitment before starting the renewal process.

How Much are Family iqama renewal fees in Saudi Arabia?

Family iqama renewal fees in saudi arabia create substantial financial obligations for expats sponsoring dependents. Each dependent requires SAR 4,800 annually, representing SAR 400 monthly dependent fees.

Family iqama extension fees in saudi arabia include separate health insurance costs ranging from SAR 600-1,200 per dependent based on coverage levels. Expatriates must maintain continuous insurance for all family members throughout the renewal period.

The basic residence permit fee of SAR 650 applies to each family member individually. This means a family of four (two parents, two children) faces SAR 2,600 in base residence fees alone.

Additional processing fees through Absher Business add SAR 51.75 per family member when employers use the platform. Family iqama renewal fees in saudi arabia can quickly exceed SAR 25,000 annually for larger families including all associated costs.

Dependent Fees in Saudi Arabia

Family iqama renewal fees in saudi arabia center around the dependent fee structure introduced to regulate expatriate family sizes. This monthly SAR 400 charge applies to spouses, children, parents, and domestic workers under foreign worker sponsorship.

Payment schedules allow expatriates to pay dependent fees quarterly (SAR 1,200), semi-annually (SAR 2,400), or annually (SAR 4,800) per dependent. Most residents in Saudi Arabia choose annual payments to minimize administrative overhead.

You get a 90-day break when your family members first arrive in Saudi Arabia. No dependent fees during this time!

This grace period gives you temporary financial relief right when you need it most. It’s designed to help you adjust your budget before the full fee obligations kick in. Use these three months wisely to plan your finances and get your family settled in the Kingdom.

Certain categories of expatriates including diplomatic staff and employees of international organizations may receive exemptions from dependent fees. These exemptions require approval from relevant ministries and proper documentation.

How to Check Saudi Iqama Renewal Dependents

Family iqama renewal fees in Saudi Arabia can be verified through the Ministry of Interior’s dependent tracking system. Expatriates can access this information through their Absher accounts by navigating to the family services sections.

The system displays current dependent status, payment history, and upcoming renewal requirements for each family member. Expats can verify which dependents are registered under their sponsorship and confirm payment obligations.

SMS notifications alert foreign workers about upcoming dependent renewal deadlines and outstanding family iqama renewal charges in saudi arabia. These automated reminders help prevent accidental lapses in family member legal status.

Mobile applications from major banks provide dependent fee payment tracking alongside other government service payments. This integration helps expats manage all family iqama renewal fees in saudi arabia from single platforms.

How to Check iqama renewal fees Online

Once you know what fees to expect, the next logical step is learning how to verify these costs yourself rather than relying on outdated information from forums or friends. The good news is that Saudi Arabia’s digital infrastructure makes it relatively straightforward to get real-time fee information, though knowing exactly where to look can save you time and frustration.

Guide to Checking iqama renewal fees Online

How to check iqama renewal fees online has become streamlined through multiple government and banking platforms. The Ministry of Interior’s official website provides the primary portal for fee verification and payment status checking.

Expatriates can how to check iqama renewal fees online by accessing the Absher portal with their residence numbers and registered mobile numbers. The system displays current fees, payment history, and upcoming renewal obligations in real-time.

The process requires valid Saudi ID numbers, current passport information, and registered contact details. How to check iqama renewal fees online also includes verification of dependent status and associated family member costs.

Banking applications integrated with government services allow international employees to how to check iqama renewal fees online while managing other financial obligations. This integration simplifies budget planning and payment scheduling for busy professionals.

Alternative Ways to Check Fees for Expatriates

How to check iqama renewal fees online extends beyond official government portals to include employer-provided systems and third-party applications. Many companies maintain internal HR portals displaying renewal costs for their international employees.

SMS services from major telecom providers offer how to check iqama renewal fees online through simple text commands. Expats can send their residence numbers to designated service codes for instant fee information.

Bank ATMs across Saudi Arabia provide government service inquiry options allowing overseas workers to how to check iqama renewal fees online without internet access. This service particularly benefits expatriates in remote areas with limited connectivity.

Professional service companies that specialize in expatriate affairs can check fees for you. They offer this as part of their complete renewal assistance packages.These services take the guesswork out of complex fee structures.

You won’t have to worry about missing any payments or getting the amounts wrong. They make sure you stay fully compliant with all the requirements. It’s like having an expert guide you through the entire process.

Consequences of Not Paying Fees

How to check iqama renewal fees online is absolutely essential when you consider the harsh penalties for late payment. Don’t take any chances with this – the consequences are serious. If you miss your payment for the first time, you’ll face an immediate SAR 500 fine.

Plus, you still owe the original renewal amount on top of that. This means you’re paying double when you could have just checked and paid on time.

Second violations double penalty amounts to SAR 1,000 while potentially blocking access to government services for expatriates. Banking, healthcare, and travel services may become inaccessible until full payment compliance.

Third violations trigger deportation proceedings that can permanently ban international residents from returning to Saudi Arabia. Immigration authorities maintain lifetime records of violations affecting future visa applications.

Employers may face business license restrictions when their sponsored expatriates fail to maintain proper payment status. This creates additional pressure on companies to monitor how to check iqama renewal fees online for all employees regularly.

Related Rules and Updates on iqama renewal fees

Staying on top of iqama renewal fees means more than just knowing the current prices – you also need to keep track of the constantly evolving regulations that can impact both costs and procedures. The Saudi government has been particularly active in recent months with policy changes that directly affect how and when residents need to renew their iqamas.

New Iqama Rules in Saudi Arabia

New iqama rules in saudi arabia introduced in 2025 reflect Vision 2030 goals of attracting skilled expatriates while managing population growth. The skill-based classification system now categorizes all work permits into High-Skilled, Skilled, and Basic levels.

New iqama rules in saudi arabia mandate biometric data updates for all renewals, requiring non-citizen residents to visit Jawazat centers for fingerprint and facial scan verification. This security enhancement affects all renewal applications regardless of previous submission history.

Health insurance integration with the Council of Cooperative Health Insurance represents major changes in new iqama rules in saudi arabia. The system automatically verifies coverage validity, eliminating manual insurance document submissions.

Remote renewal capabilities now allow expatriates to process applications while outside Saudi Arabia, provided their sponsors remain in the Kingdom. These new iqama rules in saudi arabia particularly benefit students studying abroad and frequent business travelers.

How to Renew Iqama Without Kafeel

Traditional sponsorship requirements remain fundamental to Saudi Arabia’s immigration system, making independent renewal extremely limited for most expatriates. The Green Iqama program offers the closest alternative for highly skilled professionals.

Green Iqama holders enjoy greater independence in renewal processes, though they still require employer documentation for most applications. This program targets expatriates in Vision 2030 priority sectors including technology, healthcare, and renewable energy.

Freelance visa programs introduced for specific professions allow limited independent renewal options. These visas require minimum income thresholds and professional certification maintenance throughout the validity period.

Investment-based residency programs provide pathway to reduced sponsor dependence, though minimum investment requirements exceed SAR 800,000. These programs primarily target entrepreneurs and business investors rather than typical expatriate employees.

Impact on Expatriates and Employers

New iqama rules in saudi arabia put more responsibility on your employer while giving you better digital services. Your company now has to keep your employee data updated in real-time across multiple government platforms.

This means better accuracy and faster processing for your renewals.

Your HR department now has more work to do. They must make sure all expatriate employees have current biometric data, valid health insurance, and proper job classifications. If your company doesn’t comply, they could face business license restrictions or delays in processing renewals.

But here’s the good news for you as an expatriate. You’ll enjoy streamlined digital processes and faster renewal times.

You’ll also get better transparency in fee structures. Everything becomes clearer and easier to understand. The integrated systems provide real-time status updates and automated renewal reminders.

Small businesses employing fewer than nine people receive exemptions covering up to four expatriate employees, reducing financial burden while maintaining compliance requirements. These exemptions support Vision 2030 goals of encouraging entrepreneurship and small business development.

The 7 Essential iqama renewal fees Every Expatriate Must Know

After years of confusion and conflicting information floating around expat communities, it’s time to cut through the noise with the actual numbers that matter. Let’s start with the most fundamental cost that applies to virtually every working expatriate in the Kingdom.

1. Base Residence Permit Cost – SAR 650 Annually for Expats

The fundamental iqama renewal fees that apply to all expatriates regardless of nationality or profession. This fee covers administrative processing and system maintenance for residence permits.

This standard charge remains consistent across all renewal applications processed through official channels. Expats can expect this fee to remain stable throughout 2025 based on current government policye

Payment methods include online banking, ATM transactions, and direct bank transfers. The fee must be settled before renewal processing can begin for any expats seeking to extend their legal residence status.

2. Absher Business Processing Charge – New 2025 Fee Structure

Digital service iqama renewal fees of SAR 51.75 introduced January 2025 for corporate-sponsored renewals. This charge affects expats whose employers use the Absher Business platform.

The fee represents value-added services including digital processing, automated notifications, and enhanced tracking capabilities. Foreign workers benefit from faster processing times and improved transparency in renewal status updates.

Companies can pay these residence permit renewal fees through bulk payment systems integrated with major Saudi banks. The platform automatically generates receipts and confirmation messages for expatriates once payments are completed.

3. Work Permit Authorization – SAR 9,600 Annual Cost for Expats

Monthly SAR 800 charge typically paid by employers for expatriates work authorization. This represents the largest component of total iqama renewal cost for most renewal cases.

Employers must maintain continuous payment schedules with minimum three-month advance payments required. International employees should verify their employer’s compliance to avoid renewal delays or processing complications.

Small businesses with fewer than nine employees may qualify for exemptions covering up to four foreign workers. These iqama renewal fees exemptions support Vision 2030 goals of encouraging entrepreneurship and small business development.

4. Family Dependent Sponsorship – SAR 400 Monthly Per Person

Mandatory monthly charge affecting expatriates sponsoring family members including spouse, children, and parents. These iqama renewal fees reach SAR 4,800 annually per dependent.

The first 90 days after arrival are exempt from dependent fees, providing temporary financial relief. Expats can choose quarterly, semi-annual, or annual payment schedules based on their budget preferences.

Payment responsibilities rest entirely with the sponsoring expate rather than their employer. These iqama renewal fees represent one of the most significant expenses for families living in Saudi Arabia.

5. Mandatory Health Insurance – Coverage Requirements for All

Compulsory medical insurance representing significant iqama renewal fees ranging SAR 600-1,200 annually. Coverage must remain valid for expatriates throughout the entire renewal period.

The Council of Cooperative Health Insurance automatically verifies coverage validity during renewal processing. Resident foreigners cannot complete renewals without confirmed active insurance policies meeting minimum coverage standards.

Your employer usually covers basic insurance, but you might need extra policies for your family members. These additional iqama renewal fees can vary a lot depending on what coverage you choose.

The insurance provider you pick also makes a big difference in the final cost. Shop around to find the best deal that fits your family’s needs and budget.

6. Violation Penalties – Late Payment Consequences for Expatriates

First violation results in SAR 500 added to standard iqama renewal fees, doubling to SAR 1,000 for second violations. Expatriates face deportation risks after third violations.

Grace periods allow three days beyond expiry for penalty-free renewals. Set calendar reminders 30 days before your iqama expires. This simple step helps you avoid last-minute payment complications.

Immigration authorities keep digital records of all your violations. These records will affect your future applications in the Kingdom.

These penalty iqama renewal fees can seriously impact your long-term residence plans. Don’t let a missed deadline mess up your future in Saudi Arabia.

7. Administrative Service Charges – Variable Processing Costs

Biometric updates, document processing, and passport changes create additional iqama renewal fees that vary based on individual expatriates circumstances and requirements.

Fingerprint scanning and facial recognition updates cost approximately SAR 25-50 per session. Foreign workers must complete these requirements at designated Jawazat centers before renewal approval.

Document translation, attestation, and verification services add SAR 100-300 to total iqama renewal fees. Expatriates should budget for these miscellaneous costs when planning their renewal expenses.

You might also find these useful:

- 12 Best Almarai Jobs Opportunities & Vacancies to Transform Your Career

- 10 Incredible Online Jobs in Saudi Arabia for Expatriates That Will Transform Your Career

- Saudi Labor Law: The Ultimate Guide for Expatriates

- 5 Best Driver Jobs in Riyadh: Complete Salary, Visa & Application Guide

- Ultimate Guide: 15 Booming Job Vacancies in Jeddah That Will Transform Your Career in 2025

- Driver Jobs in Saudi Arabia: Transform Your Career with 81% Market Growth & Premium Pay

- 60+ Best Part Time Jobs in Riyadh – Complete 2025 Guide

FAQ – Essential Questions Users Ask

Beyond understanding the costs involved, expatriates regularly struggle with basic administrative tasks like tracking their iqama status and expiry dates. These practical questions come up so frequently in expat forums that it’s worth addressing them directly, starting with one of the most common concerns.

How to check iqama expiry date on MOL for expatriates?

Expatriates can verify their residence permit expiry through the Ministry of Labor website by logging in with their iqama number and passport details. The system displays current validity dates and renewal requirements.

How to check iqama validity in KSA as an expatriate?

The Absher portal provides real-time iqama validity checking for expatriates using their residence numbers. The service shows current status, expiry dates, and any outstanding obligations requiring attention.

How to check iqama status online for expatriates?

You have several easy options to verify your residence permit status. You can use the MOI website, Absher app, or even your banking applications. All of these platforms give you quick access to your information.

Just make sure you have valid identification and registered contact details ready. These services need to verify who you are before showing your status information.

How to check final exit visa status as an expatriate?

Expatriates planning permanent departure can check final exit processing through Absher portal or MOI website. The system shows application status and required clearance documents.

How to check visa validity in KSA for expat?

The Ministry of Foreign Affairs portal provides visa validity checking for expatriates with multiple entry permissions. This service covers both residence and visit visa categories.

What are absher business iqama renewal fees for expatriates?

Absher Business charges SAR 51.75 per renewal transaction for corporate-sponsored expatriates. This fee covers platform services and remains separate from standard residence permit costs.

How to check iqama expiry fine for expatriates?

Penalty amounts appear in Absher portal and MOI website when expats access their profiles. The system calculates fines based on delay duration and violation history.

How to check iqama huroob status as an expat?

Runaway status verification requires Absher portal access or direct inquiry with immigration authorities. Expatriates can verify their current standing and any restrictions on their accounts.

How to pay dependent fee in Saudi Arabia as an expatriate?

Dependent fees can be paid through major bank applications, Absher portal, or designated government payment centers. Expats can choose monthly, quarterly, or annual payment schedules.

How to renew iqama without kafeel for expatriates?

Independent renewal remains limited to Green Iqama holders and specific freelance visa categories. Most expatriates require employer sponsorship for standard renewal processes

In the end, one has to admit that iqama renewal fees are a major annual expense if you’re one of the millions of expatriates living in Saudi Arabia. Your total costs could exceed SAR 15,000 for your family when you include all the mandatory charges.

Understanding these fees helps you budget better and stay legally compliant during your time in the Kingdom. Plan ahead and you’ll avoid financial stress when renewal time comes around.

Absher business iqama renewal fees and new digital processing requirements have modernized the renewal experience while adding administrative costs. Expats benefit from improved transparency and faster processing times despite increased financial obligations.

The system now combines health insurance verification, biometric updates, and dependent fee management into one renewal process. This makes things comprehensive but also more complex for you as an expatriate.

You need to plan ahead and prepare early to avoid penalties and service disruptions. Don’t wait until the last minute – start organizing your renewal requirements well before your deadline.

Stay informed about current iqama renewal fees and regulatory changes through official MOI and Absher channels. This keeps your renewals smooth and your legal residence secure.

Paying on time protects both your individual status and helps your employer stay compliant. Fee management becomes a critical part of your expat life in the Kingdom. Don’t leave it to chance – make it a priority to stay updated and pay promptly.

Sources: Saudi Gazette – Updated fee for Iqama renewal SR51.75 and reentry visa extension SR103.5 Ministry of Interior Saudi Arabia – Electronic Services Renewal of resident identity Middle East Briefing – All You Need to Know About Saudi Iqama: Procedure and Costs Saudi Company Formation – Iqama Renewal Fees in Saudi Arabia Cost & Process KSA Expats – Iqama Issuance and Renewal Fees for 2025: A Simple Guide Connect Resources – Iqama Renewal in Saudi Arabia Saudi Expatriates – Big changes to Saudi visa rules, Here’s What Expats Should Know Council of Cooperative Health Insurance – Insurance verification requirements Ministry of Labor Saudi Arabia – Work permit fee structures Absher Platform – Official government service fees